Japanese Candlestick Explanation

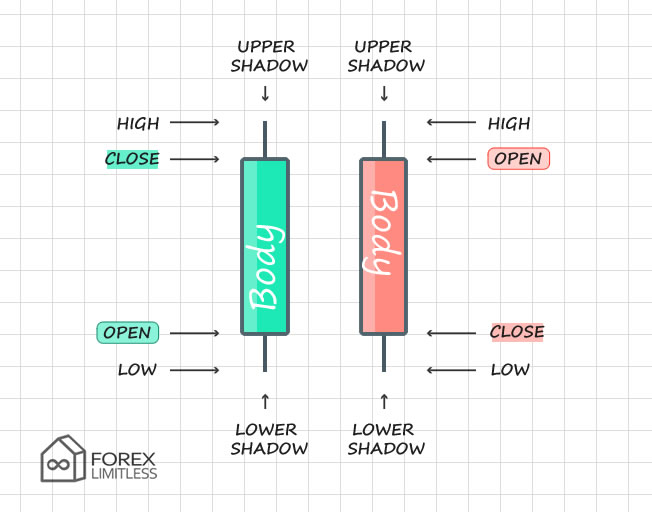

- Definition: Japanese candlestick is a price chart in trading platforms. They are used to display prices for a certain period. They are showing open, close, high, and low in a specific period.

Explained

- If the price closes above the open, then we have to buy a (long) candlestick. On our charts, it is a green candle.

- If the price closes below the open, then we have to sell a (short) candlestick In our examples it is the red candlestick.

- The center (filled part) is called the body.

- Thin lines up and down are called shadows.

- The upper shadow is high (the highest price reached in that period)

- Lower shadow represents low (the lowest price in that time frame).

There are three main categories of Japanese Candlestick Patterns.

- Bullish Reversal Candlestick Patterns.

- Bearish Reversal Candlestick Patterns.

- Continuation Candlesticks.

Bullish Reversal Patterns

- Hammer

- Piercing Pattern

- Bullish Engulfing

- The Morning Star

- Three White Soldiers

- White Marubozu

- Three Inside Up

- Bullish Harami

- Tweezer Bottom

- Inverted Hammer

- Three Outside Up

- On Neck Pattern

- Bullish Counterattack

Bearish Reversal Patterns

- 14. Hanging man

- 15. Dark Cloud Cover

- 16. Bearish Engulfing

- 17. The Evening Star

- 18. Three Black Crows

- 19. Black Marubozu

- 20. Three Inside Down

- 21. Bearish Harami

- 22. Shooting Star

- 23. Tweezer Top

- 24. Three Outside Down

- 25. Bearish Counterattack

Continuation Patterns

- 26. Falling Three Methods

- 27. Rising Three Methods

- 28. Upside Tasuki Gap

- 29. Downside Tasuki Gap

- 30. Mat Hold

- 31. Rising Window

- 32. Falling Window

Neutral Candlesticks Patterns

- 33. Doji

- 34. Spinning Top